Mergers & Acquisitions (M&A)

Planning and Integration

With the high reliance organizations have on their information technology capabilities, IT can have a significant impact on M&A costs, risks, and schedules.

The McKinsey quarterly recognized this fact in an article titled “Understanding the Strategic Value of IT in M&A.” The article asserts that a well-planned strategy for IT integration is an essential element.

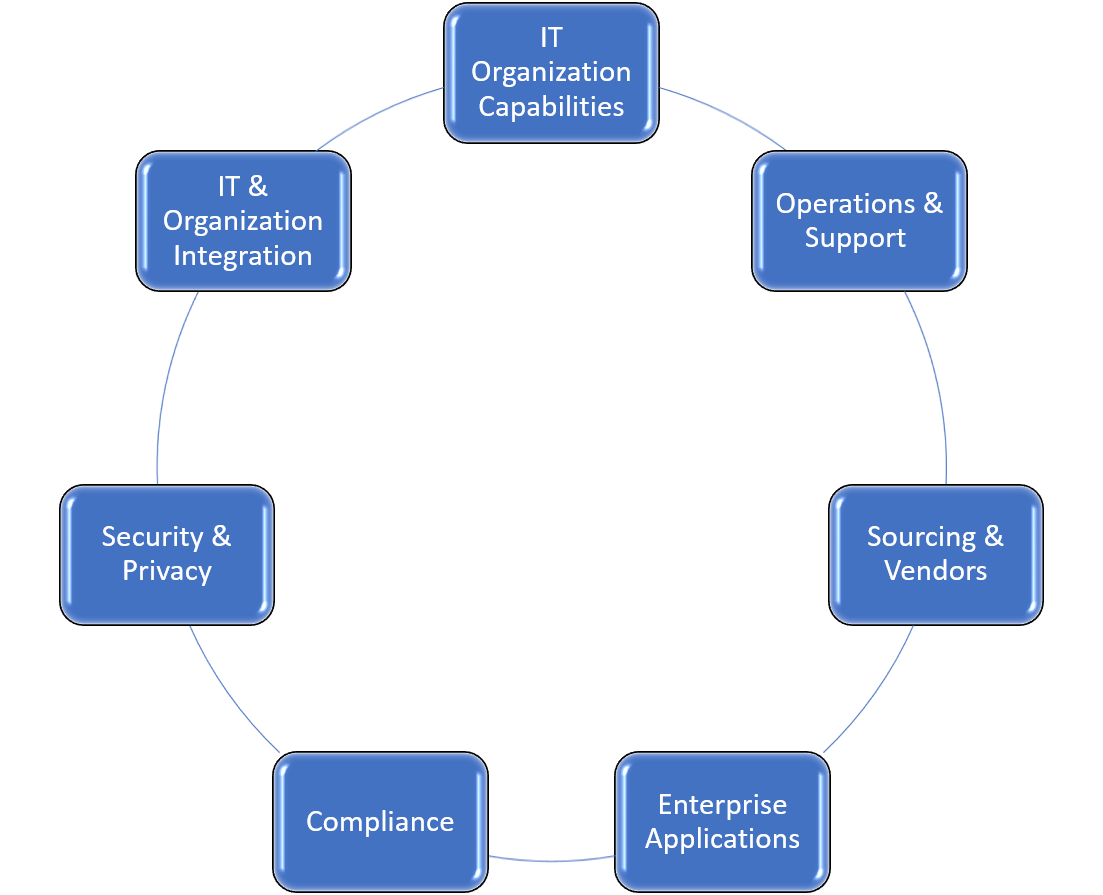

Mitigating this risk requires a detailed understanding of the IT capabilities of all the merging entities. Specifically, the following core elements must be understood:

Factoring in IT can help in establishing reasonable expectations for stakeholders from both a financial and timeline perspective. They can also drive plans which address some of M&A high-level objectives of rationalization, consolidation, standardization, and sourcing.

Early IT involvement allows for more effective consideration of technology related issues in the area of compliance, intellectual property (IP), core operations, and technology alignment – factors which can have enormous impacts on cost, value, and timeline of any M&A.

Puffin Advisors experienced team can help you throughout the M&A process. From initial due diligence reviews to building and executing integration plans. The result will be a smoother program and an ability to achieve a faster return on investment (ROI).

Our approach is straightforward and provides benefits throughout the M&A process. A customized plan is developed based on our client’s needs. Plans can include the following points:

- Analysis of / conducting IT due diligence

- Review M&A strategic, tactical, and financial goals

- Provide input to target valuation

- Develop cost/synergy estimates

- Risk identification and management

- Overall M&A program management

- Develop a Change Management plan

- Day 0 Planning

- Develop plans for post M&A activities

- Create teams required for driving the integration

- Identify additional resources/providers necessary

The Puffin team has the knowledge and experience to help IT organizations identify opportunities to improve their effectiveness and thereby provide higher value to their organizations.

Contact Puffin Advisors today and let us help your IT organization fly to the right target. Learn how we would approach your unique situation and make lasting and positive impacts. To learn about our other services, please click here.